February 5, 2026

8 Ways Agents Held Their Business Back in 2025!Discover the top mistakes agents made in 2025 that slowed their growth and learn how to avoid them in the year ahead!

December 31, 2025

Wrapping Up a Sale Before the Ball DropsSelling your home during the holidays? It's not a hurdle, it's an opportunity. Learn how to leverage the season's magic to attract serious, motivated buyers

December 26, 2025

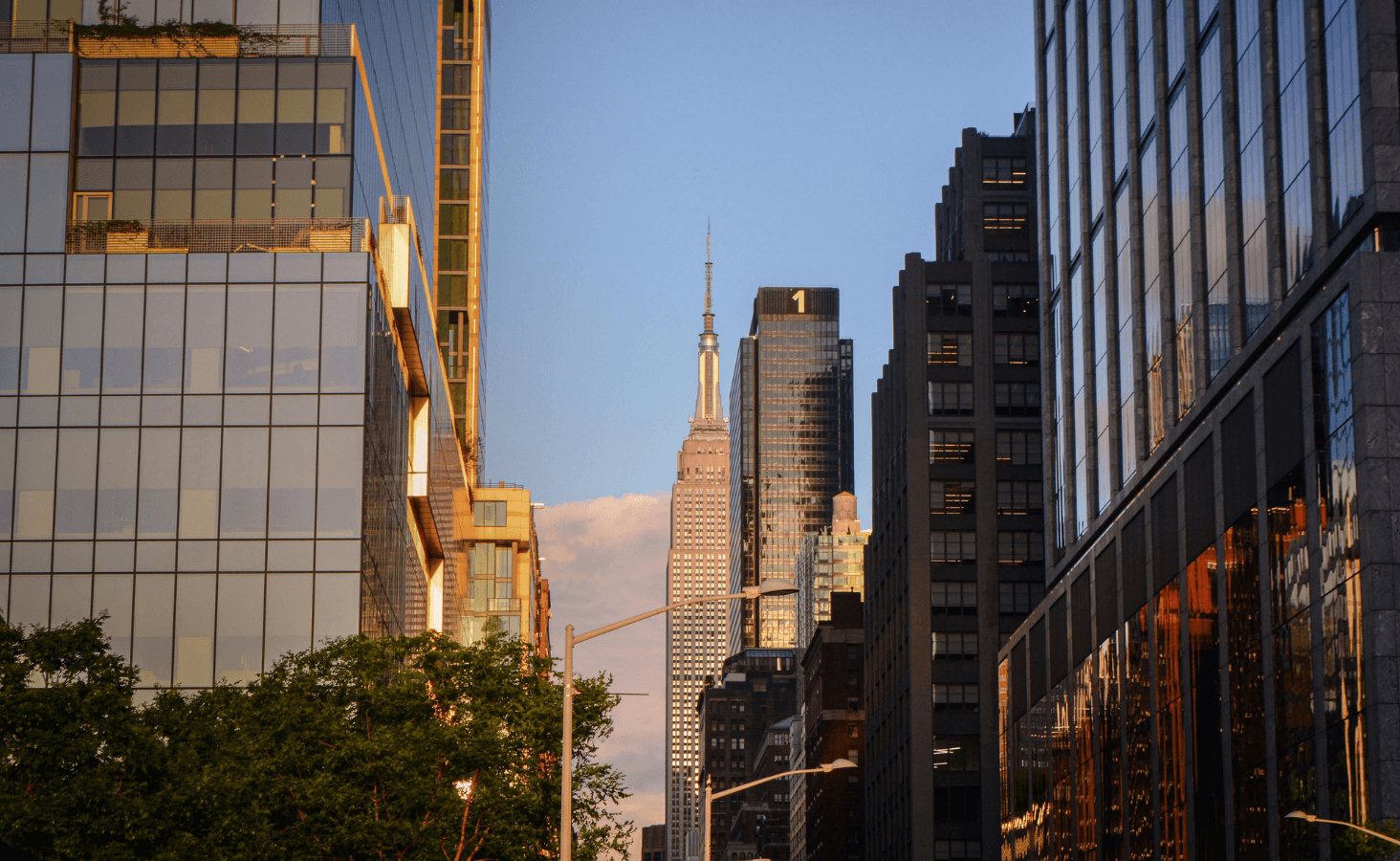

The "Year in Review" (Market Update)2025 New York Real Estate: The Year of the Great Reset

December 25, 2025

Your Cozy Holiday Home: A Gift That Lasts All YearThis holiday season, look beyond the decorations. Discover why a home is the ultimate gift of security, memories, and a place for every future Christmas.

December 25, 2025

Finding Your Hearth: The Perfect Home for Holiday GatheringsSearching for a home? Think like a holiday host! Discover the often-overlooked features that make a house perfect for creating warm, memorable gatherings year after year